Missed It by That Much

Discipline, dividends, and why waiting matters — in trading and in criminal defense

This Is Not a Trading Newsletter

This is my first — maybe only for a while — not completely criminal-law-focused piece. By which I mean there’s probably much more focus on stock trading than criminal defense today.

I was going to post it as a Facebook post, but it started getting long. And I also thought it might be useful to some people here — especially if you are young — because I want you to learn something from me that can improve your lives. I want you to be better set up for “old age” than I have been.

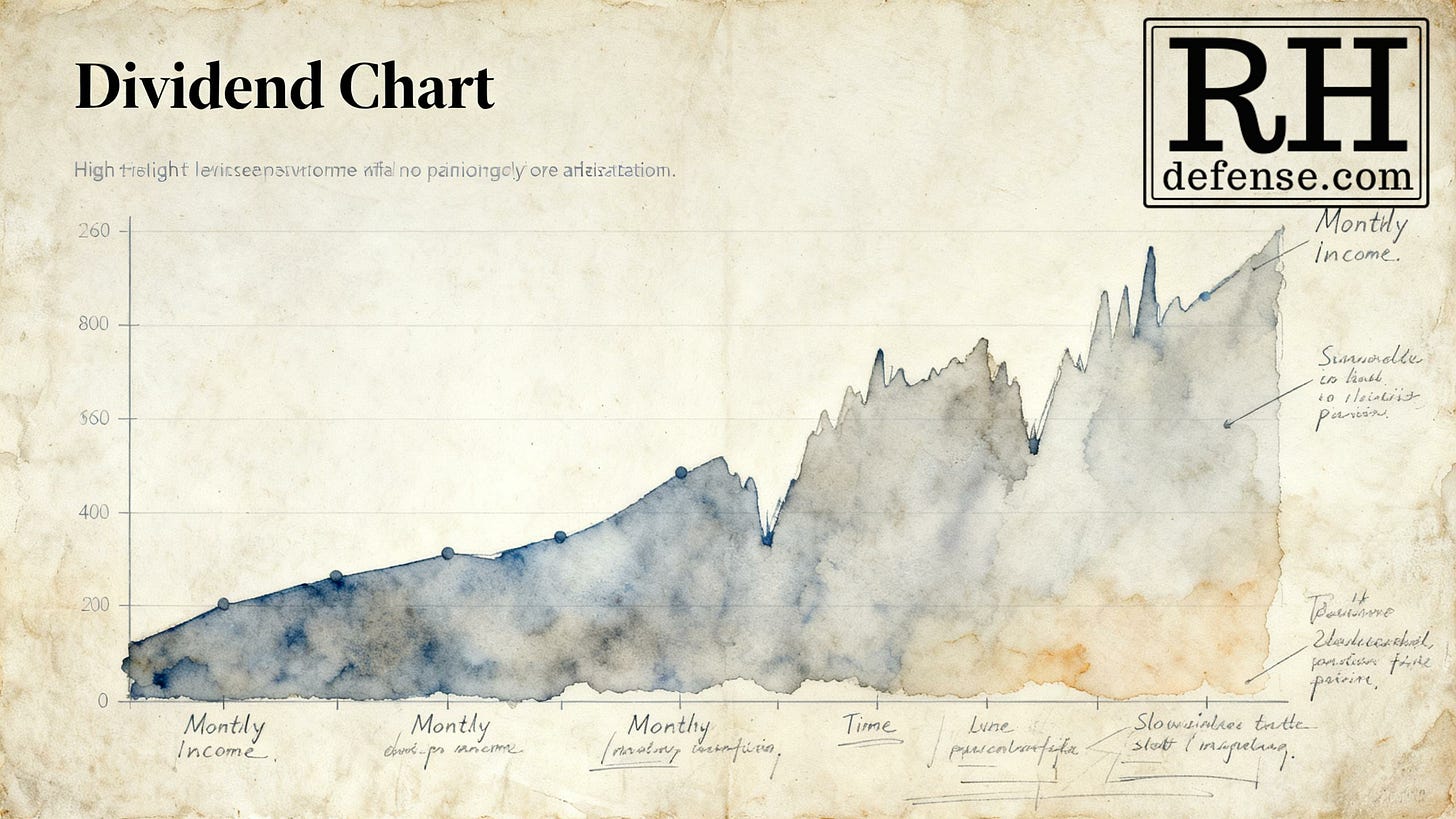

If you’re young, here’s the simplest version of what I wish I’d done earlier: start investing now, not later. Pick something boring. Set it to reinvest dividends. Put money in every month — even if it’s a laughably small amount. Fifty bucks. A hundred. Whatever you can do without noticing. Do that for thirty or forty years and you don’t end up “rich,” exactly — but you end up comfortable, unafraid, and not scrambling at the end. Even if, as some people want, Social Security is obliterated to give more tax breaks to the richest of America’s Oligarchs.

Time does the heavy lifting. You just have to show up consistently.

Anyway, this post? It’s kind of in the nature of a journal entry. I’m in that kind of mood. So it’s very different from my normal approach. And I’ll admit I had a celebratory glass of wine or three.

And so, ya. I’m gonna brag.

Because there haven’t been a lot of amazing things in my life lately, other than my friendships with people like Adi, Eric and Annie, and Bryan. (By the way, how close are we as friends? Well, those images of Eric and Annie, and Bryan, that appear on their websites? I took those photos. I didn’t know Adi well until this year, so I didn’t get the privilege of photographing her.)

Anyway, last month, I decided to explore the world of “day trading.” I’ll be frank: it’s because Google AI has been killing me and I’m trying to figure out how I’m going to retire and keep living the way I live now. This Google AI death spiral is because I’ve never really paid for advertising: I always came up top in organic searches because I’ve written somewhere in the neighborhood of 1800 blog-type articles (which are now being scraped by Google AI to give answers at the top of each search, killing traffic to my site, and hence my organic rankings).

So I’m reading a boatload of books — those of you who know me know I can plow through a few books a week when I need to do so — and I’m reading things like The Art & Science of Technical Analysis (Amazon Affiliate link) by Grimes, among others.

One of the most important things if you’re going to day trade is that you need to have discipline.

You can’t be emotional. You have to make your assessment, make your plan, and then just execute the plan.

If it goes well, great; if it goes poorly, oh well.

What matters is that you execute the plan — not that you “succeed.” I put that in quotes because you only succeed if you stick to the plan, even if the plan fails.

(Weird, huh?)

The Stock I Wasn’t Supposed to Chase

Anyway, there’s a stock I’ve been wanting to own for almost the whole last month since I started trading. This particular stock is not meant to be for day trading (by me or anyone else, I think). It’s what we call an “income stock.” It pays monthly dividends of around 45 to 55 cents per share.

I figure I need around 3,000 shares to get what I want to supplement Social Security when I start to collect it — and twice that much eventually when Dickwad Donald (Donald J. Trump) shitcans Social Security.

You might think I need more than that. And I would, if I stay in the former U.S. of A. But I’ve no plans for that. Because…Dickwad Donald.

So anyway, my long-term plan — it’s not my only plan; I’ve diversified with numerous stocks like CSCO, PLTR, NVDA, PFE, T, and others — is to start with a base of this stock.

I’m big on DRIPs — Dividend ReInvestment Plans — some of which I’ve had for 30 or more years. And I’m going to do a kind of “DRIP” with a couple of these income ETFs I’m buying. (Plus one actual DRIP using them in my self-directed IRA.)

So my long-term plan is to day trade and use my profits to fund continued trades and buy more of these income ETFs.

It depends on how well I do with trading.

But, as I said, imma brag here.

Pattern Recognition (And a Prosecutor)

It turns out that, like a lot of lawyers, I’m good at spotting things others miss. And (for me, at least) this includes patterns.

Like when, after just two or three cases, you recognize that a certain prosecutor on the “DUI team” thinks he’s a genius because he screams like a baby in the hallway after you call him out in court for repeatedly telling the court he has given you discovery when he hasn’t.

Sure, maybe he’s going to win the case in the end — maybe my client, sadly enough (I’m not talking about any particular case here), maybe had a 0.24 BAC — but the prosecutor’s belief that he’s a genius because of this is clearly…uh…okay, dude, you’re just a dumbass.

Many times, a goddamn monkey could win that case even if he pissed on his law degree and shit on his ethical requirements as a prosecutor more than you did.

Why This Actually Is a Criminal Defense Story

And here’s where this actually is a criminal defense story.

I’ve watched lawyers start talking “plea agreement” before they’ve received all the discovery. Before they’ve reviewed all the discovery. Before they’ve done any real defense investigation.

That blows my mind.

Not because plea discussions are wrong — done correctly, they’re not. The problem is that negotiating before you know the facts isn’t strategy. It’s anxiety. It’s movement for the sake of movement. It’s doing something because waiting feels unbearable.

(It could, of course, also be some unethical “pump-and-dump” — or what we sometimes call “dump trucks” (Amazon Affiliate link) — just trying to get rid of their cases as fast as possible so they get their ROI, though their client does not.)

But clients are scared. Families want answers. Silence looks like neglect — I actually spoke to someone at lunch today whose complaint about a lawyer was “she didn’t even try to talk to the DA”.

So lawyers start talking plea agreements before they know what the case actually is.

And once that happens, the posture can harden. Expectations get set. Leverage evaporates. The case starts moving down a track that’s very hard to get off — even when the facts turn out to be better than anyone realized.

Discipline, by contrast, sometimes means saying: not yet. It means getting the discovery, reviewing it, doing the defense investigation you’re supposed to do, and only then deciding how — or whether — to talk resolution.

In trading, it looks like missing fills by a penny and not flinching.

Same muscle. Same discomfort. Different charts.

The Penny I Refused to Pay

So, as I was saying, yesterday, this stock I’ve been wanting since I started paying attention to my retirement plans had been going up for the whole frickin’ month. This is damaging to my plan.

At one point, it was trading at about $56 per share. As it turns out, that was a good price.

But I didn’t like it.

So I didn’t buy it.

Fast-forward to yesterday.

The stock was trading well above — well above — $58 per share.

And while I want it, I still thought it was worth less.

I put in limit orders.

They came close three times. The first two times, I missed it by two cents. The third time, by one cent.

Yes, I thought: “Why didn’t you just buy at market?!”

But remember: discipline.

So the day ended without me getting the shares I desperately want to own before the next ex-div.

This morning, as every morning, I woke up before the market opened. I saw the stock finally down around $57.95.

I said to myself, “Self — this stock must come back down to what you think it’s worth.”

So I put in a pre-market bid for $57.80.

And mother**** me.

The market opened and my bid was the first bid of the day that got bought.

At $57.80.

Right after that, it shot back over $58.

I entered another limit order. $57.70.

And I went to court.

After court, I went to Los Panchos for an egg-and-cheese-only burrito. While desayunando, I opened my iPad.

Whoa.

The 57.70 order went through. Barely. Split into two fills.

Both orders filled.

Both at levels I thought were acceptable.

Restraint Is the Win

Not that I’m going to sell them. They’re income ETFs. Long-term plan.

But the real win here wasn’t the price.

It was not panicking. Not chasing. And not outsmarting myself.

And that’s as true in court as it is on a chart.

And yeah — I’m on my way to retirement.

I work with an attorney that needs to read this!