Halted

What a halted stock reminded me about momentum, exhaustion, and the discipline of restraint

I mentioned yesterday when I started a new series that I might interject other posts in between posts from the series. Tomorrow, I plan to come out with Part II. But something happened today….

Today I watched a stock do something I had never seen before.

It exploded upward, halted. Exploded again, halted again. And then, one more burst up with another halt.

Then fell hard — and halted a couple times on the way down.

For those who don’t know, a “halt” — also called a “circuit breaker” for obvious reasons — is a temporary pause in trading ordered by an exchange when a stock is moving too quickly or material information is being absorbed by the market. During a halt, no trades can be executed. The purpose is not to stop price movement permanently, but to slow it long enough for price discovery to resume on more equal informational footing.

Price discovery under stress.

All this surprised me a bit because I’d never seen a stock do that before. I was talking about it with ChatGPT. Chat always likes to warn me not to do something I wasn’t going to do anyway. I responded, “This is too alien to me. I’m going to sit and watch for a while.”

Now, I had already bought in before I understood what was going on — and before the halts started — and had almost immediately been “stopped out”. Again, for those who don’t know, when I bought my shares, I had put a “trailing stop” order behind the buy. The purpose of that was that if the stock suddenly dropped on me, my sell order would be triggered automatically, saving me from losing much more money during a too-quick dive. Unfortunately, my stop was a little too tight and I almost immediately got stopped out because the stock was far more volatile than I was expecting. (There was excellent news — a major new contract — and I suspect that once the news is digested, the stock may still move higher.)

A few minutes later, I decided to test if I could ride the waves and bought a much smaller position just to practice surfing. I ended up selling very shortly after because it looked to me the waves were going to come down on my head.

And then the stock absolutely went nuts. Waves? Those had been nothing. I was watching a full-on storm raging behind a tsunami of buy and sell orders.

Then the halts started. I was fascinated. I couldn’t stop watching. My heart was racing. And here’s what fascinated me the most: It was how familiar the feeling was.

That’s when I decided it was “too alien” and I wasn’t going back in.

Because this is exactly what criminal cases look like when something unexpected happens — a bad fact, a sudden filing, a media headline, a new charge.

Everything accelerates.

Everyone reacts.

No one actually knows what the case is worth yet — but too many people act as if they do.

Clients panic.

Prosecutors posture.

Judges hurry.

And the worst decisions almost always happen in those moments.

In markets, trading is halted when volatility gets too extreme — not because the system is broken, but because the system knows it can’t discover truth at that speed. The halts are triggered to give time for everyone to slow down, consider their positions, actually think about what they’re doing.

Criminal courts don’t have the safeguard of an automatic halt.

I’ve seen cases implode the same way — a single hearing, a single headline, a single bad minute — and suddenly everyone is trading on fear. Offers harden — or get worse. Positions lock. Clients want answers that don’t exist yet. The law hasn’t changed, but the temperature has. And the most dangerous moment is when movement gets mistaken for progress.

Sometimes, the best thing to do is nothing.

Instead, we call the chaos “strategy,” the overreaction “leverage,” and the pressure “efficiency.”

Why did seeing what was happening with the stock suddenly become familiar? Because in the courtroom when this happens, I virtually always call a “halt”.

“Your Honor, my client and I need time to discuss this new development. I request a continuance”.

What saved me today wasn’t being smarter than the market.

It was knowing when not to act — when to let the violence pass and wait for structure to return.

That’s the same lesson I try to teach clients.

You don’t usually win a case during the spike.

In markets, you can sometimes sell into that violence and walk away green. In court, you almost never can.

You survive it. You call a halt. You recalibrate.

The truth — like price — only emerges after the noise burns itself out.

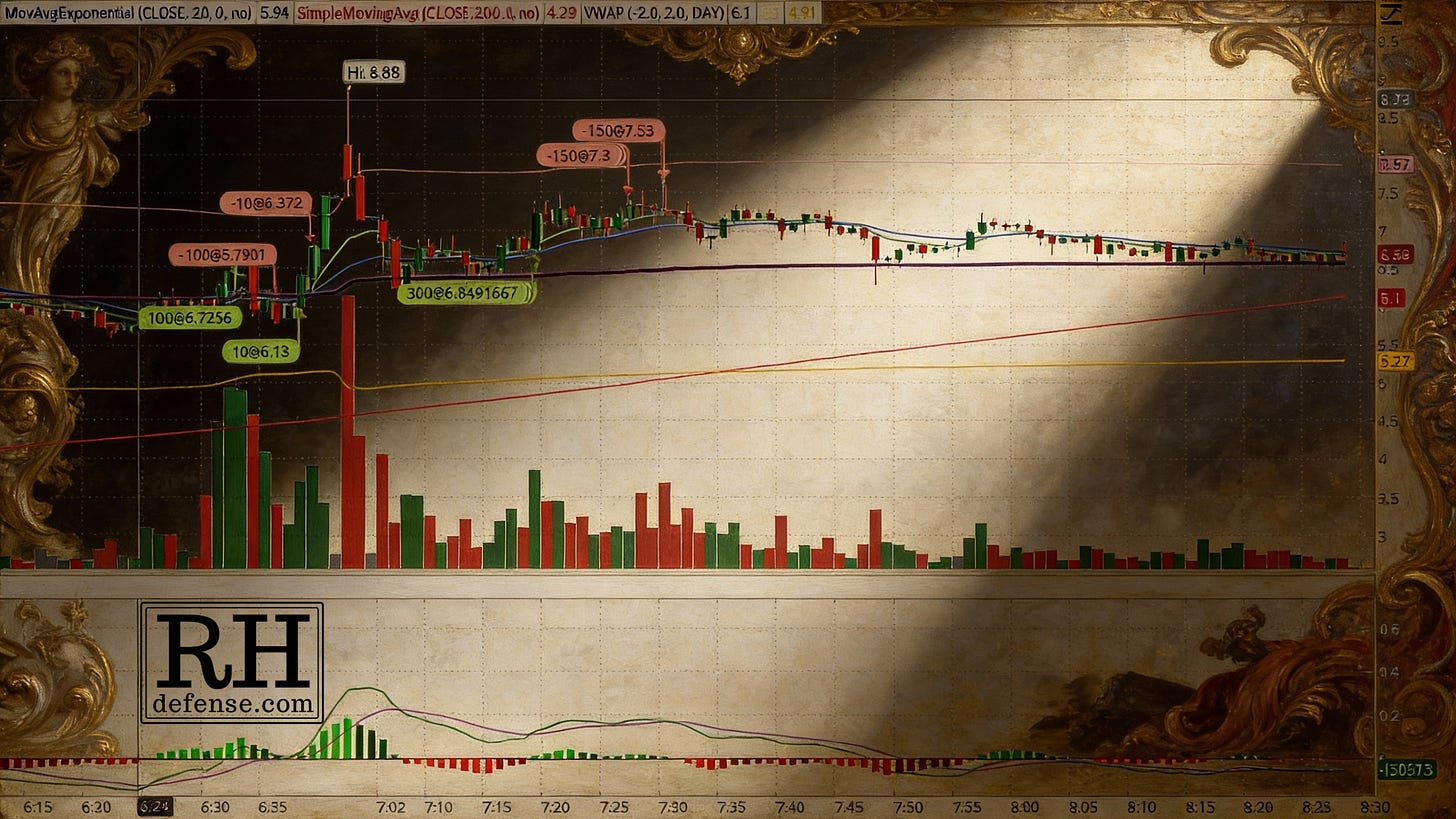

About the Chart

The chart at the top of this post is the real one from this morning.

Those bubbles aren’t annotations added later for effect. They’re my actual buys and sells — green where I entered, red where I exited — placed by the software I use to trade so I can see where I am in the grand scheme of things as the price marches on.

In the chart at the top of this post, you can see where I got stopped out early and went briefly into the red. You can see where I slowed down — waited while I absorbed the meaning of this alien experience — re-entered with more restraint, and worked my way back into the green. And you can see the moment I was taken out by a final upward twitch — a red doji’s last reach — at a price the stock never touched again. (And still hasn’t as I write this: I’ve continued watching.)

That doji blew me away — literally and figuratively — because it was so unusual. It was almost a shooting star; not quite a gravestone doji. The wick of that candle that took me out wasn’t luck: it was the buyers’ final reach upward, rejected in real time. But not before handing me a parting gift of $1,129.50.

I converted the chart into a Baroque-style image at the top of this post deliberately. Baroque art lives in moments of excess: motion, pressure, violence, light breaking through disorder. That was the emotional texture of the trade. The drama was real. The temptation to overreact was real. And the most important decision wasn’t where I got in or out — it was when I chose not to act.

I’m not posting this chart to brag, and I don’t tell war stories to impress (well, maybe I do sometimes). Here I post them to make a point: that restraint is a skill, not an absence of action.

Whether it’s a stock in freefall or a case spiraling out of control, the discipline is the same: recognize when the system has temporarily lost the ability to discover truth, call a halt, and wait until structure returns. That’s not hesitation. That’s judgment.